Why is the Indian Green Hydrogen Market an Attractive Destination for International Investment ?

The Indian green hydrogen market is an attractive destination for international investment due to several key factors:

- Government Support and Policies: India has demonstrated a strong commitment to green hydrogen through various policy initiatives and incentives. For example, the Indian government’s National Hydrogen Mission aims to scale up hydrogen production and adoption, with a target of 5 million metric tons of green hydrogen production by 2030. Additionally, the government has announced financial incentives, including subsidies and tax breaks, to encourage investment in green hydrogen projects.

- Abundant Renewable Resources: India has abundant renewable energy resources, particularly solar and wind power, which are essential for producing green hydrogen through electrolysis. The declining cost of renewable energy technologies makes green hydrogen production increasingly economically viable in India. For instance, India’s solar power tariffs have reached record lows, making solar energy one of the most cost-effective energy sources in the country.

- Growing Energy Demand: India’s rapidly growing economy and population are driving an increasing demand for energy. Green hydrogen presents a sustainable solution to meet this demand while reducing carbon emissions. Industries such as transportation, manufacturing, and power generation are expected to drive significant demand for green hydrogen in India.

- International Collaboration: India is actively engaging in international collaborations and partnerships to accelerate the development of its green hydrogen market. For example, India has joined the International Solar Alliance and the International Partnership for Hydrogen and Fuel Cells in the Economy (IPHE), which facilitate knowledge exchange and collaboration on green hydrogen technologies.

- Investment Opportunities: India offers attractive investment opportunities in green hydrogen infrastructure development, including electrolyzer manufacturing, renewable energy projects, and hydrogen refueling stations. International companies are increasingly partnering with Indian counterparts or investing directly in these projects to capitalize on the growing market.

- Market Potential: With its large population and growing economy, India represents a significant market for green hydrogen technologies and applications. As the cost of green hydrogen continues to decline and technological advancements are made, the market potential for green hydrogen in India is expected to expand further.

CURRENT GREY HYDROGEN MARKET IN INDIA

“Grey hydrogen” refers to hydrogen produced from fossil fuels, typically through a process called steam methane reforming (SMR), which emits carbon dioxide (CO2) as a byproduct. In India, the hydrogen market is still in its nascent stages, but there is growing interest and investment in hydrogen as a clean energy source.

However, India’s focus has been more on green hydrogen (produced using renewable energy sources like wind or solar power) and blue hydrogen (produced from fossil fuels but with carbon capture and storage technology to mitigate emissions). These forms of hydrogen are considered more environmentally friendly compared to grey hydrogen.

Net Zero by Narsi

Insights and interactions on climate action by Narasimhan Santhanam, Director - EAI

View full playlistThat being said, grey hydrogen still plays a role in India’s energy landscape, particularly in industries like refineries, fertilizers, and chemicals, where hydrogen is used as a feedstock. However, as India aims to reduce its carbon footprint and transition to cleaner energy sources, there may be increasing pressure to adopt technologies like carbon capture and storage (CCS) or shift towards green and blue hydrogen production methods.

ASSUMPTIONS FOR GREY HYDROGEN COST

| ASSUMPTIONS | UNITS | SMR |

| Natural Gas Input | GJ/Kg H2 | 0.18 |

| Water Use | Kg/kg H2 | 9 |

| Purchased electricity | kWh/Kg H2 | 0.96 |

| Annual O&M as % of Capex | % | 4.7% |

| Capex | $Million | 397 |

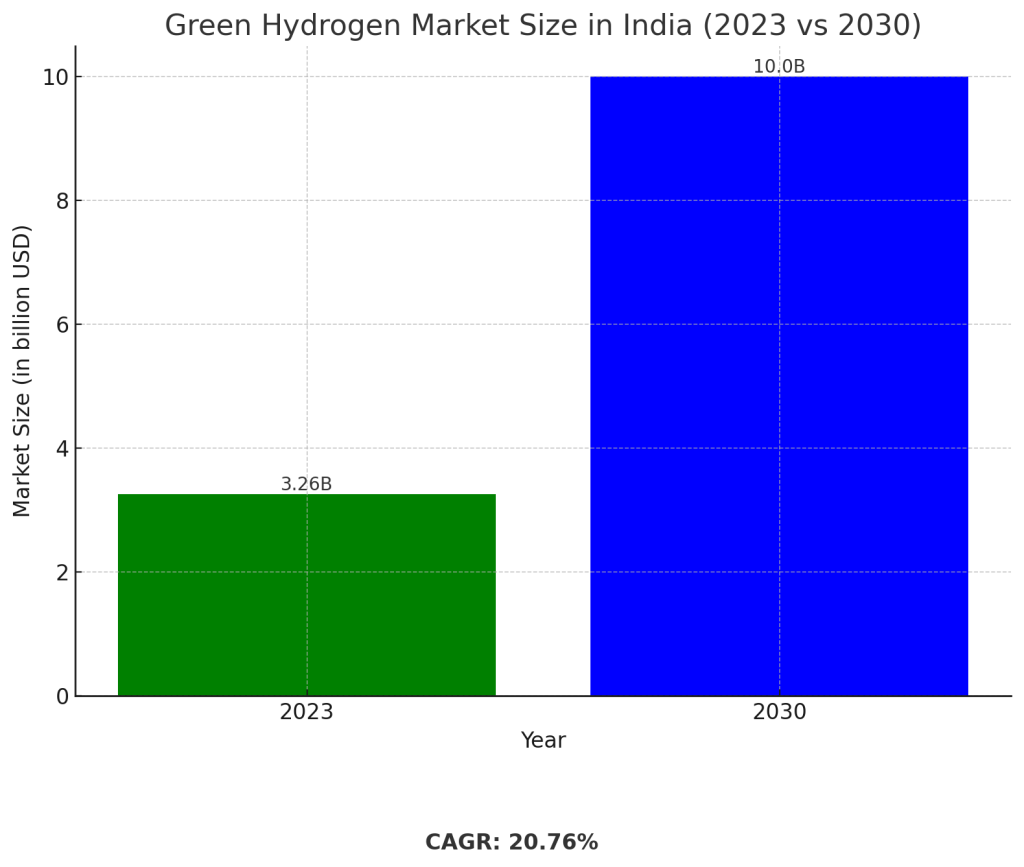

TOTAL GREEN HYDROGEN MARKET SIZE IN INDIA

- Current Market Size: The green hydrogen market in India was valued at approximately $3.26 billion in 2023.

- Market Size Projection by 2030: It is estimated to grow to $10 billion by 2030, representing a CAGR of 20.76%.

CURRENT AND EMERGING BUSINESS USE CASES FOR GREEN HYDROGEN IN INDIA

Several current and emerging business use cases for green hydrogen in India include:

- Transportation Sector:

- Fuel Cell Electric Vehicles (FCEVs): Green hydrogen can be used to power fuel cell electric vehicles, offering zero-emission transportation solutions. Companies like Tata Motors and Mahindra & Mahindra are exploring FCEVs in India.

- Fleet Operations: Green hydrogen-powered buses, trucks, and other commercial vehicles can reduce emissions in urban transportation. For example, Delhi Metro Rail Corporation (DMRC) announced plans to introduce green hydrogen-based buses.

- Power Generation:

- Renewable Integration: Green hydrogen can be produced during periods of excess renewable energy generation and used as a storage medium. This enables grid stabilization and flexibility. For instance, NTPC Ltd., India’s largest power utility, announced plans to set up green hydrogen production facilities.

- Industrial Applications:

- Steel Industry: Green hydrogen can replace coal in the steel-making process, reducing carbon emissions. Companies like JSW Steel and Tata Steel are exploring hydrogen-based steel production.

- Chemical Industry: Green hydrogen can be used as a feedstock in chemical processes, such as ammonia production. Gujarat Alkalies and Chemicals Ltd. (GACL) announced plans to produce green hydrogen for ammonia synthesis.

- Energy Storage and Grid Balancing:

- Storage Solutions: Green hydrogen can store excess renewable energy for later use, providing grid stability. Companies like Indian Oil Corporation Ltd. (IOCL) are exploring green hydrogen-based energy storage solutions.

- Grid Balancing: Green hydrogen can provide grid balancing services, helping to manage fluctuations in renewable energy generation.

- Hydrogen-based Economy Development:

- Hydrogen Corridors: Establishing hydrogen refueling infrastructure along key transportation routes to support FCEVs.

- Hydrogen Hubs: Developing clusters for green hydrogen production, storage, and distribution, fostering collaboration among industry stakeholders.

Specific Data Points:

- According to a report by The Energy and Resources Institute (TERI), India’s green hydrogen demand could reach 5.7 million tons by 2050, driven by sectors like transportation, industry, and power generation.

- The Indian government’s National Hydrogen Energy Mission aims to establish a green hydrogen ecosystem with a target of 5 GW of electrolyzer capacity by 2025 and 10 GW by 2030.

- The Indian Oil Corporation Ltd. (IOCL) plans to invest around ₹32,946 crores (approximately $4.5 billion) in green hydrogen and related projects by 2027.

KEY INDIAN PLAYERS IN THE INDIAN GREEN HYDROGEN MARKET

- Indian Oil Corporation Limited (IOCL):

- IOCL, India’s largest oil refining and marketing company, has announced significant investments in green hydrogen projects.

- In December 2021, IOCL unveiled plans to invest ₹32,946 crores (approximately $4.5 billion) in green hydrogen and related projects by 2027.

- The company aims to establish green hydrogen production facilities, including electrolyzers powered by renewable energy sources, to support its transition towards cleaner fuels.

- NTPC Limited:

- NTPC Limited, India’s largest power utility, is actively exploring green hydrogen as part of its renewable energy portfolio.

- The company plans to set up green hydrogen production facilities with a focus on integrating hydrogen into its power generation and industrial applications.

- NTPC aims to achieve a green hydrogen capacity of 10 GW by 2030, contributing to India’s National Hydrogen Energy Mission.

- Tata Group:

- Tata Group, one of India’s largest conglomerates, is involved in various initiatives related to green hydrogen.

- Tata Steel, a subsidiary of Tata Group, is exploring hydrogen-based steel production as part of its decarbonization efforts.

- Tata Motors, another subsidiary, is conducting research and development on fuel cell electric vehicles (FCEVs) powered by green hydrogen.

- GAIL (India) Limited:

- GAIL (India) Limited, a leading natural gas company, has expressed interest in green hydrogen and is exploring its potential in India.

- The company is studying various aspects of green hydrogen production, storage, and distribution, considering its role in India’s energy transition.

- GAIL is exploring partnerships and collaborations to advance green hydrogen initiatives in the country.

- Reliance Industries Limited:

- Reliance Industries Limited (RIL), one of India’s largest conglomerates, has announced plans to invest in green energy projects, including hydrogen.

- RIL aims to develop green hydrogen production capacity, leveraging its expertise in renewable energy and petrochemicals.

- The company is exploring opportunities to integrate green hydrogen into its existing operations and supply chains.

KEY INTERNATIONAL AND GLOBAL PLAYERS IN INDIAN GREEN HYDROGEN MARKET

- Siemens Energy:

- Siemens Energy, a global energy technology company, is actively involved in the Indian green hydrogen market.

- In September 2021, Siemens Energy signed a Memorandum of Understanding (MoU) with Greenko Group, a leading renewable energy company in India, to explore opportunities in green hydrogen production and storage.

- Adani Group:

- The Adani Group, one of India’s largest conglomerates with diversified business interests, is focusing on green hydrogen as part of its renewable energy portfolio.

- In November 2021, Adani Green Energy Ltd. announced plans to invest $20 billion in building a green hydrogen manufacturing facility in Gujarat, India, with an annual capacity of 5 GW by 2030.

- Linde plc:

- Linde plc, a global industrial gases and engineering company, is actively involved in the development of green hydrogen infrastructure in India.

- In June 2021, Linde Engineering India, a subsidiary of Linde plc, signed an MoU with Indian Oil Corporation Ltd. (IOCL) to jointly explore opportunities for the development of green hydrogen projects in India.

- ENGIE:

- ENGIE, a global energy company, is exploring opportunities in the Indian green hydrogen market.

- In November 2021, ENGIE and Greenko Group announced a strategic partnership to develop renewable energy projects, including green hydrogen, in India. The partnership aims to accelerate India’s transition to a low-carbon economy.

- Nikola Corporation:

- Nikola Corporation, a global transportation and energy technology company, is collaborating with Indian partners to introduce hydrogen fuel cell electric vehicles (FCEVs) in India.

- In December 2021, Nikola Corporation announced a partnership with CNH Industrial India, a subsidiary of CNH Industrial N.V., to introduce FCEVs and related infrastructure in India.

GOVERNMENT POLICIES FOR GREEN HYDROGEN

| Initiative | Description |

|---|---|

| National Hydrogen Energy Mission (NHEM) | Promote the development and adoption of hydrogen energy technologies, including green hydrogen. Aims to establish India as a global hub for green hydrogen production and export. Targets include achieving 5 GW of hydrogen production capacity by 2025 and 10 GW by 2030. |

| Production Linked Incentive (PLI) Scheme | Incentivize the manufacturing of green hydrogen production equipment and components. Provides financial incentives to eligible manufacturers based on their production output. Aims to boost domestic manufacturing capacity and reduce reliance on imported equipment. |

| Renewable Energy Policies | Various state governments in India have implemented policies and targets that indirectly support green hydrogen development. States like Gujarat, Karnataka, and Rajasthan have ambitious renewable energy targets and offer incentives for renewable energy projects, including green hydrogen production. |

| Research and Development (R&D) Initiatives | Supports R&D initiatives in green hydrogen through agencies like the MNRE and DST. Funding programs and grants are available for research institutions, universities, and companies engaged in developing green hydrogen technologies and solutions. |

KEY CHALLENGES FACED BY INDIAN GREEN HYDROGEN MARKET

- Cost Competitiveness: The cost of green hydrogen production, particularly through electrolysis using renewable energy sources, is currently higher compared to conventional methods of hydrogen production. This cost competitiveness issue needs to be addressed through technological advancements, economies of scale, and supportive policies to make green hydrogen more competitive with conventional hydrogen.

- Infrastructure Development: The lack of infrastructure for green hydrogen production, storage, and distribution is a significant challenge. Developing the necessary infrastructure requires substantial investment and coordination among various stakeholders. This includes building electrolyzer manufacturing facilities, hydrogen storage facilities, and establishing a hydrogen distribution network.

- Renewable Energy Integration: Green hydrogen production relies on renewable energy sources such as solar and wind power. However, the intermittent nature of renewable energy sources poses challenges for consistent and reliable hydrogen production. Effective integration of renewable energy into the grid and grid-balancing solutions are needed to ensure reliable green hydrogen production.

- Scale-Up Challenges: Scaling up green hydrogen production from pilot projects to commercial-scale operations poses technical and economic challenges. Issues such as efficiency improvements, electrolyzer manufacturing scalability, and supply chain constraints need to be addressed to achieve large-scale green hydrogen production at competitive costs.

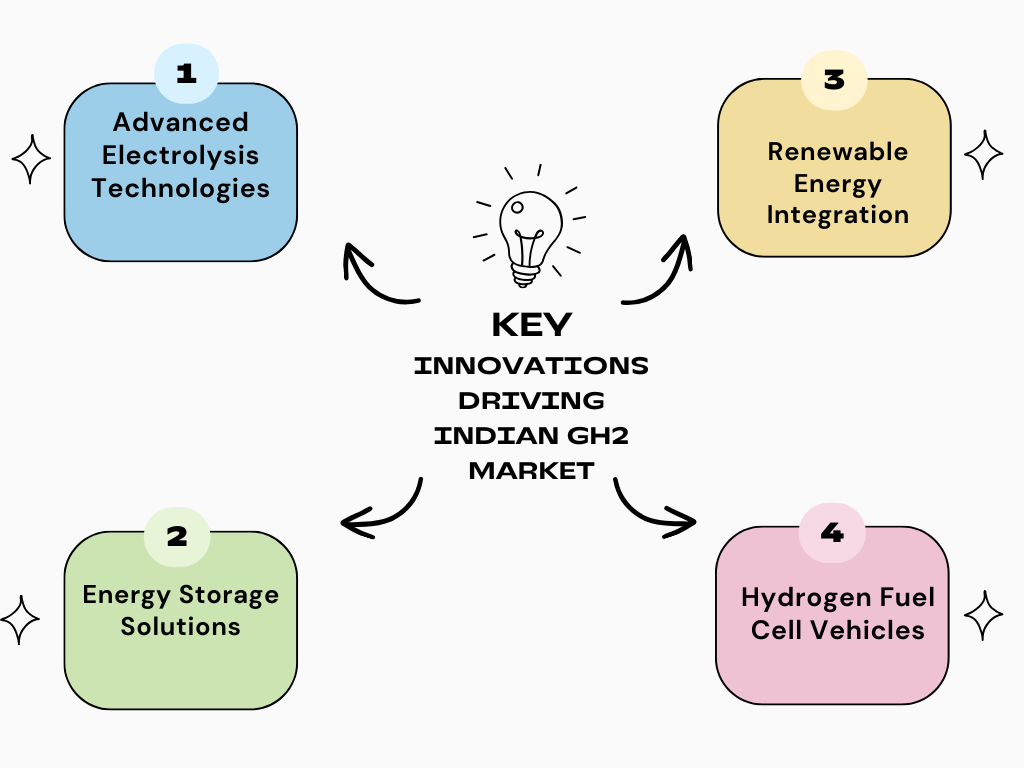

KEY INNOVATIONS DRIVING INDIAN GREEN HYDROGEN MARKET

- Advanced Electrolysis Technologies: Innovations in electrolysis technologies, such as proton exchange membrane (PEM) electrolyzers and alkaline electrolyzers, are driving down the cost of green hydrogen production. These advancements improve efficiency, reduce energy consumption, and increase the scalability of electrolysis systems, making green hydrogen more economically viable.

- Renewable Energy Integration: Innovations in renewable energy technologies, including solar photovoltaics (PV) and wind turbines, are crucial for driving the green hydrogen market. Advancements in solar and wind power generation, such as higher efficiency panels and larger wind turbines, increase the availability of renewable energy for green hydrogen production, lowering its overall cost.

- Energy Storage Solutions: Innovations in energy storage technologies, such as hydrogen storage systems and batteries, play a crucial role in enabling the widespread adoption of green hydrogen. Advances in hydrogen storage materials and technologies improve efficiency and reduce costs, making it feasible to store and transport green hydrogen for various applications

- Hydrogen Production from Biomass: Innovations in biomass conversion technologies, such as gasification and pyrolysis, enable the production of green hydrogen from biomass feedstocks. Biomass-derived hydrogen offers a sustainable alternative to fossil fuels and can help address waste management challenges while producing renewable hydrogen.

- Hydrogen Fuel Cell Vehicles: Innovations in hydrogen fuel cell vehicle technology drive demand for green hydrogen as a clean transportation fuel. Advancements in fuel cell technology, including higher power density and longer lifespan, improve the performance and reliability of hydrogen fuel cell vehicles, making them a viable alternative to traditional internal combustion engine vehicles.

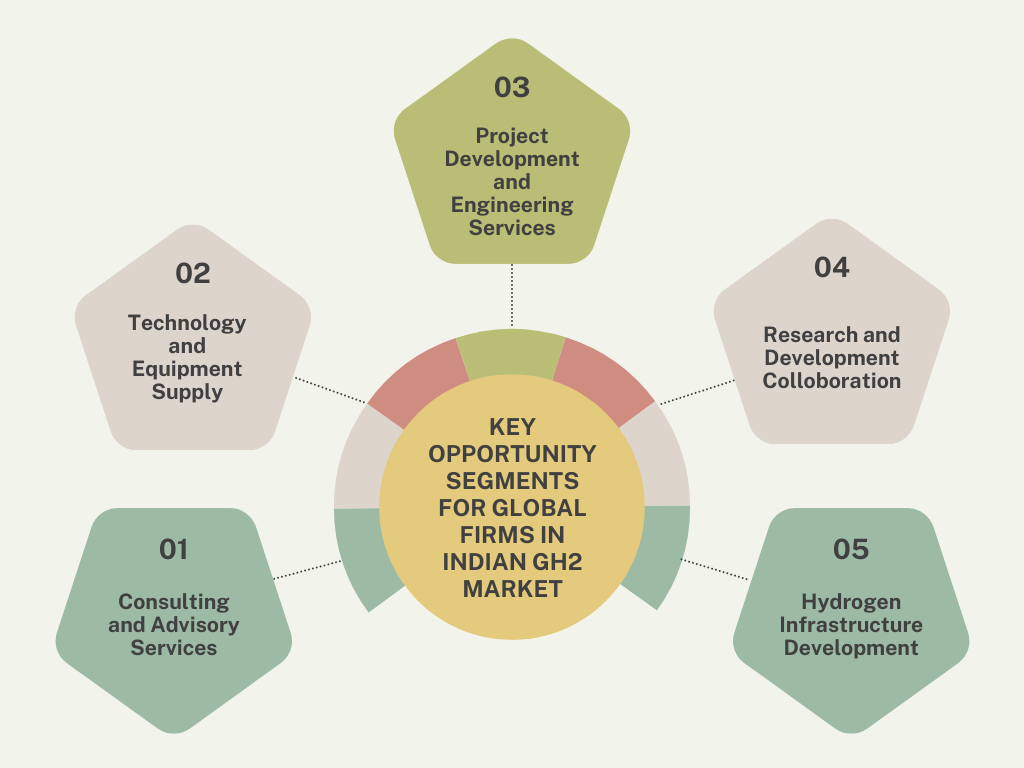

KEY OPPORTUNITY SEGMENTS FOR INTERNATIONAL FIRMS IN INDIAN GREEN HYDROGEN MARKET

- Technology and Equipment Supply: International firms specializing in green hydrogen production technologies, such as electrolyzers, renewable energy systems (solar, wind), hydrogen storage solutions, and hydrogen fuel cells, have significant opportunities in supplying advanced equipment and technology to Indian projects.

- Project Development and Engineering Services: International firms with expertise in project development, engineering, procurement, and construction (EPC) services for green hydrogen production facilities can partner with Indian companies to develop and execute green hydrogen projects across the country.

- Research and Development Collaboration: International firms engaged in research and development (R&D) related to hydrogen technologies can collaborate with Indian research institutions, universities, and companies to advance innovation and develop new technologies for green hydrogen production, storage, and utilization.

- Consulting and Advisory Services: International consulting firms specializing in energy, sustainability, and clean technology can provide advisory services to Indian companies, government agencies, and policymakers on green hydrogen strategy, market analysis, policy development, and project implementation.

- Hydrogen Infrastructure Development: International firms with experience in developing hydrogen infrastructure, including hydrogen refueling stations, distribution networks, and storage facilities, can partner with Indian companies to establish a robust hydrogen infrastructure ecosystem in the country.

Our specialty focus areas include

Our specialty focus areas include

India Big Business Opportunities in Climate Tech – List – EAI

India Big Business Opportunities in Climate Tech – List – EAI