Why is the Indian Low Carbon Building Materials Market an Attractive Destination for International Investment ?

- Rapid Urbanization and Construction Growth:

- India is experiencing rapid urbanization, with a significant increase in construction activities to accommodate the growing urban population.

- According to the Indian Ministry of Housing and Urban Affairs, India is expected to witness an investment of USD 1.3 trillion in urban infrastructure over the next 20 years.

- The construction sector is a major consumer of building materials, driving demand for low carbon alternatives.

- Government Initiatives and Policies:

- The Indian government has launched various initiatives and policies to promote sustainable construction and green building practices.

- The Green Building Council of India (GBCI) estimates that green building projects in India are expected to increase from 3.5 billion square feet in 2018 to 10 billion square feet by 2022.

- Initiatives such as the Green Rating for Integrated Habitat Assessment (GRIHA) and Leadership in Energy and Environmental Design (LEED) certification promote the adoption of low carbon building materials.

- Environmental Concerns and Regulations:

- Growing environmental concerns, including climate change and air pollution, are driving the demand for low carbon building materials that have a reduced environmental footprint.

- Regulatory measures such as the Energy Conservation Building Code (ECBC) mandate energy-efficient building design and construction practices, encouraging the use of low carbon materials.

- Market Potential and Growth:

- The Indian low carbon building materials market is witnessing significant growth due to increasing awareness about sustainability among developers, architects, and consumers.

- According to a report by Research and Markets, the Indian green building materials market is projected to grow at a CAGR of over 9% between 2020 and 2025.

- International investors can capitalize on this growth potential by investing in innovative low carbon building materials and technologies.

- Innovations and Technological Advancements:

- Technological advancements in material science and construction techniques have led to the development of innovative low carbon building materials with enhanced performance and sustainability.

- Materials such as recycled concrete, fly ash bricks, bamboo-based composites, and low embodied carbon cement are gaining traction in the Indian construction industry.

- International investors can bring expertise, research, and development capabilities to further innovate and commercialize low carbon building materials in India.

KEY INDIAN PLAYERS IN INDIAN LOW CARBON BUILDING MATERIALS MARKET

- ACC Limited:

- ACC Limited is one of the leading cement manufacturers in India, known for its focus on sustainability and environmentally friendly products.

- The company offers a range of low carbon and sustainable cement products, including blended cements with reduced clinker content.

- ACC Limited has implemented various initiatives to reduce carbon emissions and promote sustainable construction practices.

- ACC Limited reported consolidated net sales of over INR 16,200 crore (approximately USD 2.18 billion) in the financial year 2020-21.

- UltraTech Cement Limited:

- UltraTech Cement Limited is the largest manufacturer of grey cement, ready mix concrete (RMC), and white cement in India.

- The company has a strong focus on sustainability and offers a wide range of low carbon cement products, including blended cements and alternative fuel usage in production.

- UltraTech Cement Limited has been recognized for its efforts in reducing carbon emissions and promoting sustainable construction practices.

- UltraTech Cement Limited reported consolidated net sales of over INR 44,000 crore (approximately USD 5.93 billion) in the financial year 2020-21.

- JSW Cement Limited:

- JSW Cement Limited is a subsidiary of JSW Group, one of India’s leading conglomerates.

- The company is known for its environmentally friendly cement products, including Portland slag cement (PSC) and blended cements with reduced clinker content.

- JSW Cement Limited has invested in advanced technologies to reduce carbon emissions and promote sustainable construction.

- Specific data points: JSW Cement Limited reported consolidated net sales of over INR 4,300 crore (approximately USD 578 million) in the financial year 2020-21.

- Greenply Industries Limited:

- Greenply Industries Limited is a leading manufacturer of plywood, laminates, and decorative veneers in India.

- The company offers sustainable and low carbon building materials, including eco-friendly plywood and particle boards made from renewable sources.

- Greenply Industries Limited has a strong focus on environmental sustainability and green manufacturing practices.

- Specific data points: Greenply Industries Limited reported consolidated net sales of over INR 2,200 crore (approximately USD 296 million) in the financial year 2020-21.

- Everest Industries Limited:

- Everest Industries Limited is a prominent manufacturer of building solutions, including roofing sheets, pre-engineered buildings, and wall panels.

- The company offers low carbon building materials, including eco-friendly roofing solutions made from recycled materials.

- Everest Industries Limited emphasizes sustainability and green building practices in its product offerings.

- Specific data points: Everest Industries Limited reported consolidated net sales of over INR 1,200 crore (approximately USD 161 million) in the financial year 2020-21.

KEY INTERNATIONAL AND GLOBAL PLAYERS IN INDIAN LOW CARBON BUILDING MATERIALS MARKET

- Saint-Gobain:

- Saint-Gobain is a global leader in building materials, including sustainable solutions for construction.

- The company offers a wide range of low carbon building materials such as eco-friendly glass products, insulation materials, and sustainable construction systems.

- Saint-Gobain has a significant presence in India through its subsidiary Saint-Gobain India Pvt. Ltd.

- Specific data points: Saint-Gobain reported global sales of approximately EUR 38.1 billion (around USD 43 billion) in 2020.

- LafargeHolcim:

- LafargeHolcim is a global leader in building materials and solutions, focusing on sustainable construction practices.

- The company offers a variety of low carbon building materials, including sustainable cement, concrete, and aggregates.

- LafargeHolcim operates in India through its subsidiary ACC Limited, which is one of the key players in the Indian cement industry.

- Specific data points: LafargeHolcim reported global net sales of CHF 23.1 billion (around USD 25.5 billion) in 2020.

- BASF SE:

- BASF SE is a global chemical company that offers a wide range of sustainable solutions for the construction industry.

- The company provides low carbon building materials such as eco-friendly insulation materials, construction chemicals, and sustainable coatings.

- BASF has a presence in India through its subsidiary BASF India Limited.

- Specific data points: BASF reported global sales of EUR 59.1 billion (around USD 67.1 billion) in 2020.

- Knauf:

- Knauf is a global manufacturer of building materials, including sustainable solutions for the construction industry.

- The company offers low carbon building materials such as eco-friendly gypsum boards, insulation materials, and drywall systems.

- Knauf operates in India through its subsidiary Knauf India Pvt. Ltd.

- Specific data points: Knauf reported global sales of EUR 10 billion (around USD 11.3 billion) in 2020.

- Dow Inc.:

- Dow Inc. is a global materials science company that offers sustainable solutions for various industries, including construction.

- The company provides low carbon building materials such as eco-friendly insulation materials, adhesives, and sealants.

- Dow Inc. has a presence in India through its subsidiary Dow Chemical International Pvt. Ltd.

- Specific data points: Dow Inc. reported global net sales of USD 46.3 billion in 2020.

GOVERNMENT POLICIES FOR LOW CARBON BUILDING MATERIALS:

| Policy | Description | Specific Data Points |

|---|---|---|

| GRIHA (Green Rating for Integrated Habitat Assessment) | A green building rating system providing guidelines for assessing environmental performance, including low carbon materials. Encouraged by the Indian government. | Over 7,000 projects registered as of January 2022, covering over 900 million square feet. |

| ECBC (Energy Conservation Building Code) | Sets minimum energy performance standards for new commercial buildings and major renovations to encourage energy efficiency and low carbon materials. | Several states and union territories in India have adopted and implemented ECBC for new construction projects as of January 2022. |

| NAPCC (National Action Plan on Climate Change) | Outlines strategies to mitigate climate change impacts, including sustainable construction practices and low carbon materials. Aims to reduce construction sector emissions. | Aims to reduce the intensity of India’s GDP emissions by 20-25% by 2020 compared to 2005 levels. |

| NMEEE (National Mission for Enhanced Energy Efficiency) | Includes sub-programs like MTEE to promote energy-efficient technologies and materials in construction. Offers financial incentives and technical assistance. | Aims to achieve energy savings of 23 Mtoe and reduce CO2 emissions by 98.55 million tonnes by 2019-20. |

Net Zero by Narsi

Insights and interactions on climate action by Narasimhan Santhanam, Director - EAI

View full playlistKEY CHALLENGES FACED BY INDIAN LOW CARBON BUILDING MATERIALS MARKET:

- Cost Considerations:

- One of the primary challenges faced by the Indian low carbon building materials market is the higher initial cost compared to conventional materials.

- According to industry reports, low carbon building materials such as eco-friendly insulation, sustainable concrete, and green roofing solutions can cost up to 20-30% more than traditional materials, posing a barrier for widespread adoption, particularly in cost-sensitive markets.

- Lack of Awareness and Education:

- There is a lack of awareness and understanding among consumers, builders, architects, and developers about the benefits and availability of low carbon building materials.

- A survey conducted by the Indian Green Building Council (IGBC) found that only a small percentage of respondents were aware of green building concepts and materials, highlighting the need for education and awareness programs.

- Limited Availability and Supply Chain Challenges:

- Low carbon building materials often have limited availability in the Indian market, leading to challenges in sourcing and procurement.

- According to industry sources, the availability of certified low carbon building materials such as sustainable timber, recycled steel, and eco-friendly insulation is limited in India, resulting in supply chain constraints and higher lead times.

- Regulatory and Policy Barriers:

- Regulatory barriers and inconsistencies in building codes, standards, and certifications pose challenges for the adoption of low carbon building materials.

- While initiatives such as the Energy Conservation Building Code (ECBC) and green building rating systems promote sustainable construction practices, there is a need for harmonization and alignment of regulations to facilitate the use of low carbon materials.

- Technical Challenges and Performance Concerns:

- Some low carbon building materials may have technical limitations or performance concerns compared to conventional materials, affecting their acceptability and adoption.

- Studies have identified challenges related to the durability, fire resistance, and structural performance of certain low carbon materials, raising concerns among builders and developers about their suitability for use in construction projects.

- Perception of Quality and Aesthetics:

- The perception of low carbon building materials as inferior in quality or aesthetics compared to conventional materials is a challenge in the Indian market.

- Specific data points: Surveys have indicated that perceptions of low quality, durability, and aesthetic appeal hinder the adoption of low carbon materials, despite their environmental benefits.

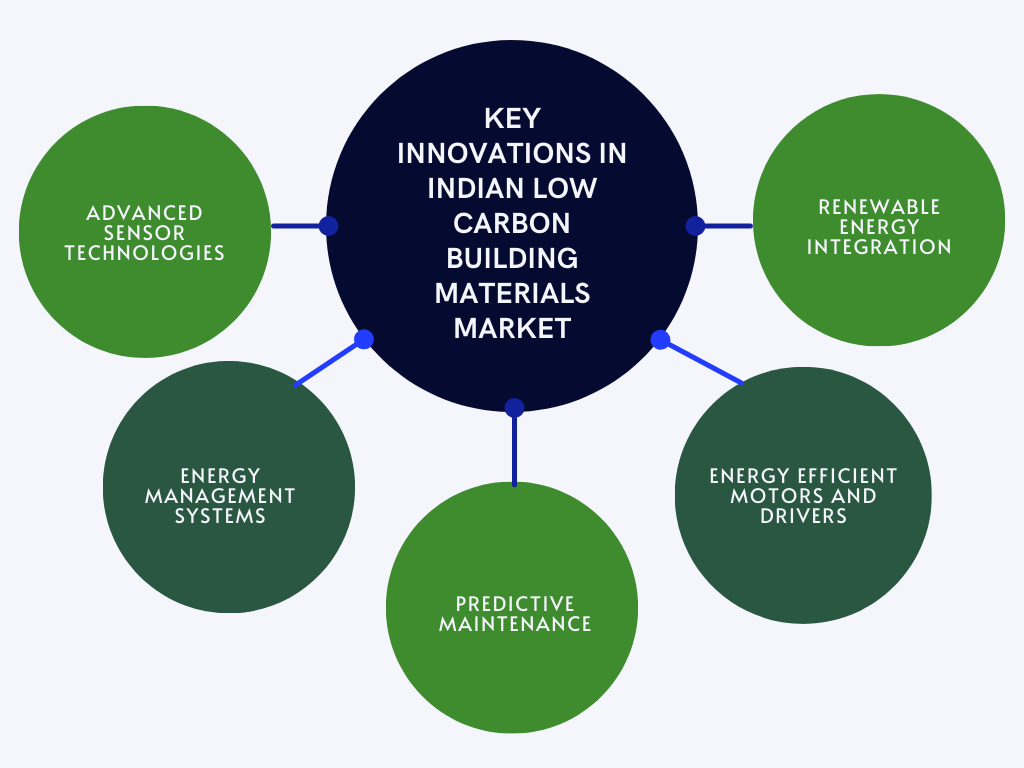

KEY INNOVATIONS DRIVING THE INDIAN INDUSTRIAL ENERGY EFFICIENCY MARKET

- Advanced Sensor Technologies:

- Advanced sensor technologies, including Internet of Things (IoT) sensors and smart meters, enable real-time monitoring of energy usage in industrial processes.

- These sensors provide accurate data on energy consumption, allowing industries to identify inefficiencies and optimize energy usage.

- The global industrial IoT market size is projected to grow from USD 77.3 billion in 2021 to USD 110.6 billion by 2025, with a compound annual growth rate (CAGR) of 7.4% during the forecast period.

- Energy Management Systems (EMS):

- Energy Management Systems (EMS) use advanced software platforms to monitor, analyze, and optimize energy consumption in industrial facilities.

- EMS solutions integrate data from various sources, including sensors, meters, and production systems, to identify energy-saving opportunities and implement energy efficiency measures.

- The global energy management system market size is expected to reach USD 62.3 billion by 2027, growing at a CAGR of 13.2% from 2020 to 2027.

- Predictive Maintenance:

- Predictive maintenance utilizes machine learning algorithms and data analytics to predict equipment failures and optimize maintenance schedules.

- By identifying potential equipment failures in advance, predictive maintenance reduces downtime, improves asset reliability, and minimizes energy waste associated with inefficient equipment operation.

- The global predictive maintenance market size is projected to reach USD 15.1 billion by 2026, growing at a CAGR of 25.4% from 2021 to 2026.

- Energy-Efficient Motors and Drives:

- Energy-efficient motors and variable frequency drives (VFDs) optimize energy consumption in industrial processes by adjusting motor speed and torque based on demand.

- These motors and drives reduce energy wastage associated with constant-speed operation, resulting in significant energy savings.

- According to the International Energy Agency (IEA), industrial motor systems account for approximately 66% of global manufacturing electricity consumption, highlighting the potential for energy savings through the adoption of energy-efficient motors and drives.

- Renewable Energy Integration:

- Integration of renewable energy sources such as solar, wind, and biomass into industrial operations reduces reliance on grid electricity and lowers carbon emissions.

- Innovative technologies such as solar photovoltaic (PV) panels, wind turbines, and biomass boilers enable industries to generate clean energy onsite and reduce energy costs.

- The Indian government aims to achieve 175 GW of renewable energy capacity by 2022, including 100 GW of solar capacity and 60 GW of wind capacity, signaling significant opportunities for renewable energy integration in industrial sectors.

Our specialty focus areas include

Our specialty focus areas include