Significant business opportunity for Lithium sourcing from Argentina for EV batteries.

Greetings from EAI.

As you will be aware, EAI (Energy Alternatives India) is India’s leading renewable energy and cleantech consulting firm. We have been offering boutique marketing and management consultancy for over ten years, and have served over 300 premium Indian and international clients – the likes of Reliance, World Bank, Vedanta, Bosch, GE, GSK, Bill & Melinda Gates Foundation, JSW and many others.

EAI has been retained by a firm that owns significant Lithium reserves in Argentina to identify Indian companies keen on entering into long term contracts to source the Lithium for India.

As the use of electric vehicles accelerates worldwide, with consequent opportunities for large-scale Li-ion battery manufacturing in the near future, having a secure source of Lithium for the next few decades could be a strong competitive advantage for many Indian companies.

Net Zero by Narsi

Insights and interactions on climate action by Narasimhan Santhanam, Director - EAI

View full playlistCurrently, EAI is soliciting from leading companies who could have an interest in Lithium battery manufacturing and/or being a critical source of supply of Lithium to other stakeholders.

As this is a significant opportunity to have ownership of a scarce but critical resource, companies interested can send in a note of interest to the undersigned to take the discussions to the next level.

I look forward to talking to you soon.

Regards,

Narasimhan Santhanam

Co-founder & Director

EAI – Energy Alternatives India @ www.eai.in

narsi@eai.in

More details about the opportunity

- The company has a large ground position in lithium brine lakes in Argentina, along with a number of prospects in Western Australia.

- The firm has ambitions to become a leading supplier of not just Lithium, but also materials needed for new battery technology, primarily lithium with nickel, cobalt, graphite and related minerals

- The company is led by an experienced team, with 4 out of 5 directors or advisors having worked at leading global mining and mineral extraction firms for over 30 years

- They also have extensive Argentinian and chemicals industry expertise, which bodes well for a group which has amassed a considerable ground position in one of the world’s pre-eminent lithium districts and is focused on quick development of asset

Other Highlights of the Opportunity

- Large Ground Positions: Exploration tenements or applications of over 416,000 Ha in Argentina and 23,000 Ha in Western Australia, prospective for hard rock lithium, cobalt, nickel, gold and base metals.

- Experience & Technology: Four key personnel involved have a detailed understanding of the chemicals business, from manufacturing through to marketing. The new chemical extraction method planned for the brines (being developed with technology partners) offers to increase the amount of products available for sale. The team is well connected and focused.

- Early Stage Opportunity: The projects are relatively early stage, and the new processing technology being developed in-house by the group. Such a situation provides an early stage opportunity to investors keen on significant upsides in future.

- Other Opportunities: The company has a number of opportunities under consideration which can be brought into the group post listing, and the global network of the Board is considered a strength in terms of attracting business partners such as offtakers, engineering groups and end users to participate in project investment once the economic merits can be demonstrated.

Lithium in Argentina

There are forecasts for Argentina to become the world’s biggest supplier of lithium, with annual production capacity of 165,000 tonnes. More majors are looking at South America and Argentina in particular as an entry point into the lithium sector. Quite a few companies have experienced strong growth being in Argentina.

An early mover into the Argentinean lithium space was ASX listed Orocobre which operates the CauchariOlaroz mine in partnership with Toyota Tsusho Corp. It produced around 12,000 tons of lithium carbonate in 2018 (as of end June). The company has been a major success story. It has been the only new brine entrant in more than a decade.

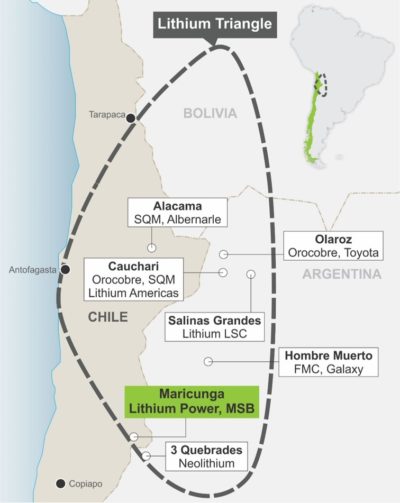

More than half of the world’s known lithium reserves are located in Argentina, Bolivia and Chile. Combined, the reserves in these Latin American countries are between 50 percent and 75 percent of global deposits. Because of the area’s vast lithium resources, it is known as the South American Lithium Triangle.

Our client has two major projects in Argentina, the first is La Antigua or La Rioja project, which is an exploration license application covering 211,300 hectares (2111 km2 ) at low elevation (276 m), 80 km south-east of the La Rioja township. The State owned Hydrocarbon’s company conducted exploration from 1991-1995, drilling holes up to 150 m deep. Recent sampling showed moderate lithium grades above 500 ppm, with very low magnesium to lithium ratio (magnesium causes complications in the extraction process).

Sydney based geological consultants Geos Mining conducted work on the project in 2017, including site inspections. The second project area is called Pipanaco. The Pipanaco Project spans the provinces of Catamarca and La Rioja within the hydrogeological basin of the Salar de Pipanaco and at an altitude of approximately 800 meters above sea level.

This consists of Pipanco North and Pipanco South. A hydrogeological study by a local group in 2013 indicated the presence of Lithium

throughput the Pipanaco area. Further confirmation and testing are being done as of mid 2018.

All about Lithium

What is Lithium and How Is It Used?

Lithium is the world’s lightest metal. Dubbed “white petroleum” due to its common usage in state-of-the-art batteries, the use of lithium-ion for batteries is because it lighter, more efficient, and more durable than other competing technologies. This makes it a desirable choice for energy storage, particularly in vehicles and consumer electronics where weight and heavy usage is a significant consideration. The use of Li-ion batteries can be for a wide range of applications where lower weight is critical – applications such as electric vehicles, smartphones, laptops, cameras etc.

Interestingly, as of 2017, a large share of Lithium use & demand came from industrial applications, such as glass, ceramics, lubricants, and casting powders. The future demand for Li, however, is expected to be driven predominantly through its use in Lithium based batteries.

What is the extent of Li demand expected from electric vehicles?

While Li can be used for batteries in many applications, the extent of its use will be much higher per electric car than it will be for any other – a premium electric car could contain as much as 60 Kg of Li in its batteries, while a laptop will contain perhaps 0.1 Kg, a tablet about 0.05 Kg and a smartphone, 0.01 Kg. That is, an electric vehicle could contain 5000 times or more Li than a smartphone!

Where do we get Lithium from?

With our current knowledge of mineral and metal deposits, Lithium deposits are mostly prevalent in South America, particularly in the so-called Lithium Triangle – Bolivia, Chile, and Argentina. These three countries alone are expected to possess over 60% of total known Li reserves in the world. China is said to have about 25% of the world’s deposits (Lucky fellows, the Chinese).

Lithium comes from two main sources: brine and hard rock. Brine deposits are found in salt lakes and lithium is extracted through an evaporation process. Brine harvesting is more common and often considered a simpler method of extraction, but generally of lower grade. Hard rock lithium mining requires geological surveys and drilling through rock, which can increase costs, but also often results in higher grades.

What could be Lithium’s future potential?

There are three important trends that will continue to provide support for lithium demand growth over the coming years:

- Electric vehicles powered by lithium batteries continue to see scaling production levels and committed capital investments. As Li-batteries appear to be the only large-scale alternative now for lightweight rechargeable batteries, a massive growth in EVs will mean a massive growth in Lithium demand.

- Mobile device penetration and growth. Pretty much everyone will be having a Lithium based mobile phone soon in most but the poorest parts of the world. While the amount of Li in a mobile phone is very small, the large number of mobile phones sold every year implies reasonable Li demand from this segment for the foreseeable future.

- Energy storage for renewable energy power plants, especially solar and wind power plants, could be a large growth area in future, especially as these renewable source start entering the mainstream from being marginal players in the overall power generation. As both solar and wind are infirm power sources, a stabilizing avenue in the form of storage could make these sustainable and fairly inexpensive sources of power highly attractive investments worldwide, consequently resulting in a significant growth for Lithium demand

Check out: EAI Consulting for Electric Mobility – Electric Vehicles, EV Components & EV Charging Infrastructure

Our specialty focus areas include

Our specialty focus areas include